All Categories

Featured

Table of Contents

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. accidental death insurance brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

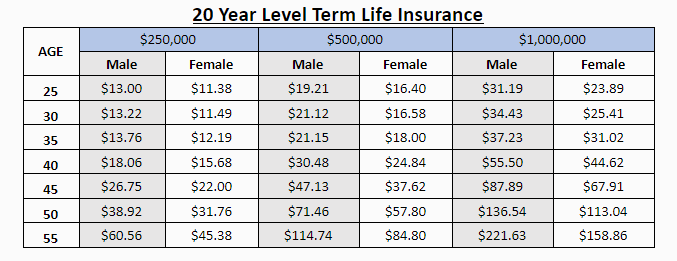

If you pick degree term life insurance, you can allocate your premiums due to the fact that they'll stay the very same throughout your term. And also, you'll recognize precisely just how much of a death benefit your recipients will certainly get if you pass away, as this quantity will not change either. The rates for level term life insurance policy will depend upon numerous aspects, like your age, health standing, and the insurer you pick.

Once you go with the application and clinical exam, the life insurance coverage business will certainly examine your application. Upon authorization, you can pay your first costs and authorize any type of pertinent documents to guarantee you're covered.

Aflac's term life insurance policy is practical. You can pick a 10, 20, or three decades term and appreciate the added peace of mind you deserve. Collaborating with an agent can aid you locate a policy that works finest for your requirements. Find out more and obtain a quote today!.

As you try to find means to protect your economic future, you've most likely encountered a wide range of life insurance policy options. what is direct term life insurance. Picking the right protection is a large choice. You wish to find something that will assist sustain your enjoyed ones or the reasons vital to you if something happens to you

Several people lean toward term life insurance for its simpleness and cost-effectiveness. Level term insurance policy, however, is a type of term life insurance that has regular settlements and a changeless.

Level Term Life Insurance Definition

Level term life insurance policy is a subset of It's called "level" since your premiums and the benefit to be paid to your enjoyed ones remain the exact same throughout the agreement. You will not see any adjustments in expense or be left questioning its worth. Some agreements, such as every year eco-friendly term, may be structured with premiums that raise with time as the insured ages.

They're determined at the beginning and continue to be the exact same. Having constant repayments can aid you better plan and budget plan since they'll never ever transform. Fixed fatality advantage. This is also set at the start, so you can recognize specifically what survivor benefit amount your can expect when you die, as long as you're covered and up-to-date on premiums.

You agree to a fixed costs and death benefit for the duration of the term. If you pass away while covered, your fatality advantage will certainly be paid out to liked ones (as long as your costs are up to date).

You might have the option to for one more term or, most likely, renew it year to year. If your agreement has a guaranteed renewability clause, you may not require to have a new medical examination to keep your protection going. Your premiums are likely to enhance since they'll be based on your age at renewal time.

With this choice, you can that will certainly last the remainder of your life. In this situation, once more, you might not require to have any type of brand-new clinical tests, yet premiums likely will rise as a result of your age and brand-new coverage. short term life insurance. Various business offer various choices for conversion, make certain to understand your choices prior to taking this action

Sought-After Level Term Life Insurance Meaning

Speaking to a financial advisor also might aid you figure out the course that lines up ideal with your general approach. Most term life insurance policy is level term throughout of the contract duration, but not all. Some term insurance may feature a costs that enhances with time. With reducing term life insurance, your fatality advantage drops gradually (this kind is often taken out to especially cover a lasting financial obligation you're repaying).

And if you're established for eco-friendly term life, after that your premium likely will go up annually. If you're exploring term life insurance and desire to make sure uncomplicated and predictable monetary defense for your family members, level term may be something to take into consideration. However, similar to any type of kind of insurance coverage, it may have some limitations that do not meet your demands.

Expert Annual Renewable Term Life Insurance

Usually, term life insurance policy is more budget friendly than permanent coverage, so it's a cost-efficient method to secure financial security. Flexibility. At the end of your contract's term, you have several options to proceed or go on from coverage, frequently without needing a medical examination. If your budget or protection needs change, death benefits can be lowered over time and outcome in a reduced costs.

As with other kinds of term life insurance policy, as soon as the contract ends, you'll likely pay higher premiums for coverage because it will certainly recalculate at your current age and health. If your financial circumstance modifications, you may not have the essential coverage and might have to acquire additional insurance.

Yet that does not imply it's a suitable for everybody. As you're buying life insurance policy, right here are a couple of essential elements to think about: Budget plan. One of the benefits of degree term coverage is you understand the price and the fatality benefit upfront, making it simpler to without bothering with boosts with time.

Normally, with life insurance policy, the healthier and younger you are, the more affordable the insurance coverage. If you're young and healthy and balanced, it might be an enticing option to lock in reduced premiums currently. If you have a young household, for instance, degree term can assist give economic support during vital years without paying for insurance coverage much longer than necessary.

1 All riders are subject to the terms and conditions of the cyclist. Some states may differ the terms and conditions.

2 A conversion credit is not readily available for TermOne policies. 3 See Term Conversions area of the Term Series 160 Item Guide for just how the term conversion debt is determined. A conversion credit scores is not readily available if costs or charges for the brand-new plan will be waived under the terms of a biker giving impairment waiver advantages.

Effective A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

Term Series products are released by Equitable Financial Life Insurance Coverage Company (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Coverage Company of California, LLC in CA; Equitable Network Insurance Coverage Agency of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance is a type of life insurance policy that covers the policyholder for a specific amount of time, which is recognized as the term. Terms commonly vary from 10 to 30 years and rise in 5-year increments, giving level term insurance coverage.

Latest Posts

How To Sell Final Expense Insurance

Death Burial Insurance

Funeral Cover Up To 85 Years