All Categories

Featured

Table of Contents

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. life insurance for business owners through brokers. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

It enables you to budget plan and plan for the future. You can easily factor your life insurance into your budget due to the fact that the premiums never change. You can prepare for the future equally as conveniently because you know specifically how much cash your liked ones will certainly obtain in case of your lack.

This is true for individuals who stopped cigarette smoking or that have a health condition that settles. In these cases, you'll normally have to go through a brand-new application procedure to get a much better rate. If you still require coverage by the time your degree term life plan nears the expiry day, you have a couple of choices.

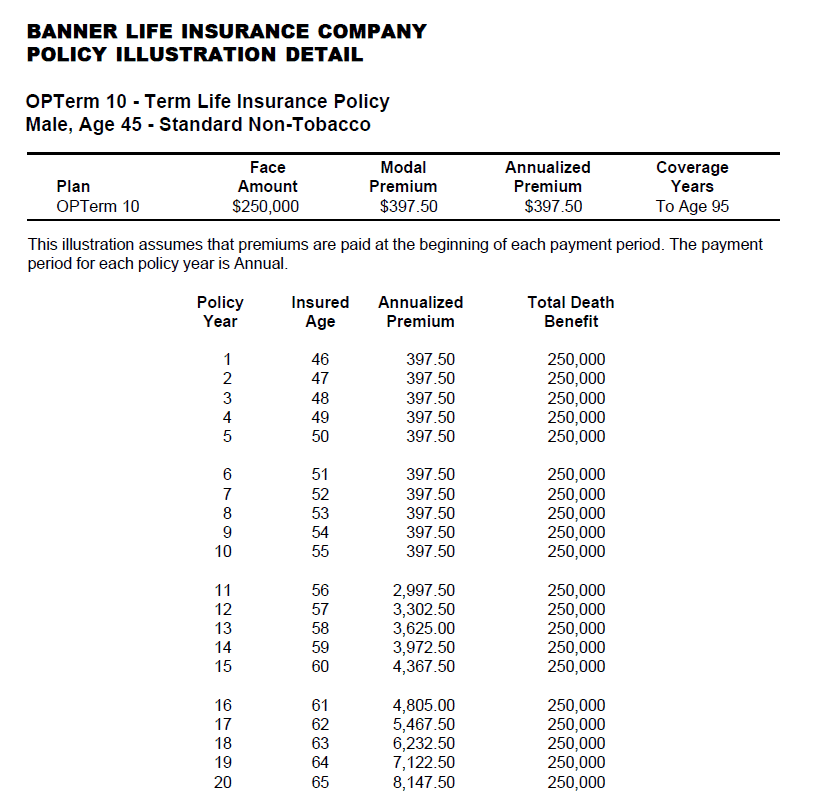

Most degree term life insurance policy plans include the option to renew coverage on a yearly basis after the preliminary term ends. group term life insurance tax. The price of your plan will be based on your present age and it'll raise yearly. This could be a great alternative if you only require to extend your protection for 1 or 2 years or else, it can get costly quite quickly

Degree term life insurance policy is one of the most affordable protection options on the market because it supplies standard protection in the form of death advantage and just lasts for a set amount of time. At the end of the term, it expires. Whole life insurance policy, on the other hand, is substantially extra costly than degree term life since it does not run out and includes a cash money value function.

Top What Is Level Term Life Insurance

Prices may vary by insurance provider, term, insurance coverage amount, health course, and state. Level term is a fantastic life insurance choice for the majority of people, but depending on your coverage requirements and personal scenario, it may not be the ideal fit for you.

Annual renewable term life insurance coverage has a regard to just one year and can be renewed yearly. Yearly sustainable term life premiums are initially lower than degree term life costs, yet prices increase each time you restore. This can be an excellent alternative if you, for example, have just stop smoking cigarettes and require to wait 2 or three years to make an application for a degree term plan and be eligible for a reduced price.

A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

, your fatality advantage payout will lower over time, yet your payments will certainly remain the same. On the various other hand, you'll pay more ahead of time for much less coverage with an increasing term life plan than with a level term life policy. If you're not sure which kind of plan is best for you, functioning with an independent broker can aid.

When you've made a decision that level term is best for you, the following step is to acquire your plan. Here's exactly how to do it. Determine exactly how much life insurance policy you need Your coverage quantity need to offer your family's long-lasting monetary demands, consisting of the loss of your revenue in case of your death, in addition to debts and day-to-day costs.

A degree costs term life insurance coverage strategy allows you stick to your spending plan while you assist protect your household. ___ Aon Insurance Coverage Providers is the brand name for the broker agent and program management operations of Affinity Insurance policy Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Firm, Inc. (CA 0795465); in OK, AIS Fondness Insurance Policy Services Inc.; in CA, Aon Affinity Insurance Services, Inc.

The Strategy Representative of the AICPA Insurance Policy Trust Fund, Aon Insurance Solutions, is not connected with Prudential.

Latest Posts

How To Sell Final Expense Insurance

Death Burial Insurance

Funeral Cover Up To 85 Years