All Categories

Featured

Table of Contents

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - whole life insurance for infinite banking brokers specialize in. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

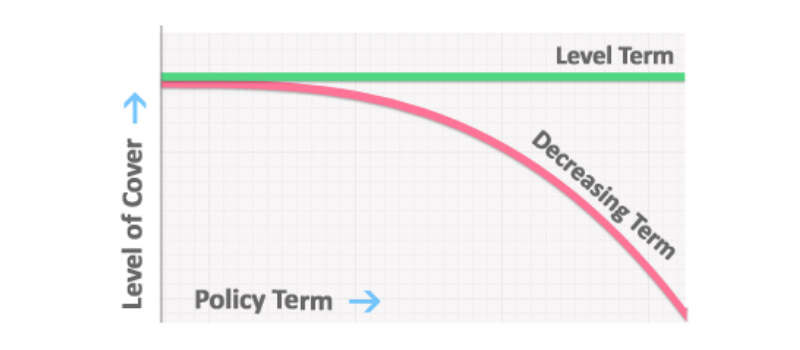

There is no payment if the policy runs out prior to your fatality or you live past the plan term. You might be able to renew a term plan at expiration, but the premiums will be recalculated based on your age at the time of revival.

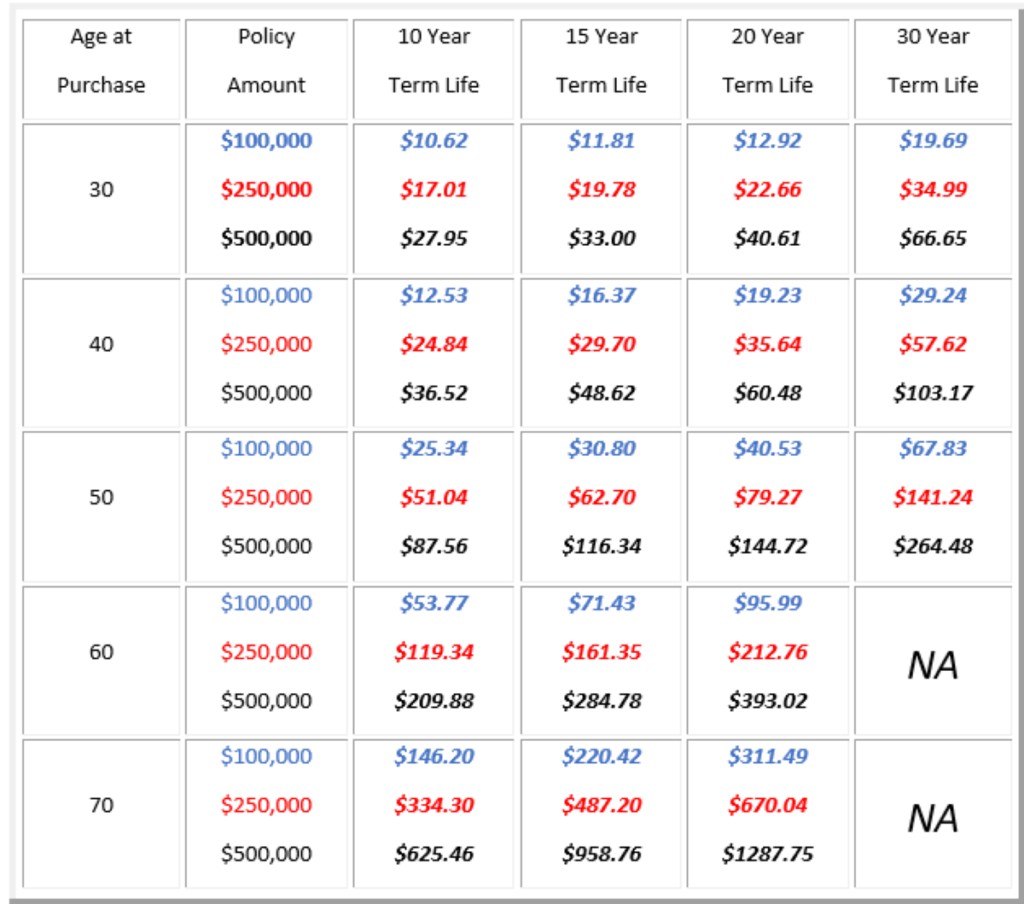

At age 50, the premium would increase to $67 a month. Term Life Insurance Policy Fees thirty years old $18 $15 40 years of ages $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and females in outstanding health and wellness. In contrast, below's a look at prices for a $100,000 whole life plan (which is a sort of permanent policy, implying it lasts your life time and consists of money value).

Interest prices, the financials of the insurance firm, and state regulations can also influence costs. When you take into consideration the quantity of insurance coverage you can obtain for your costs bucks, term life insurance has a tendency to be the least expensive life insurance.

Thirty-year-old George intends to shield his family members in the not likely event of his early death. He buys a 10-year, $500,000 term life insurance coverage policy with a premium of $50 each month. If George dies within the 10-year term, the plan will pay George's beneficiary $500,000. If he passes away after the plan has expired, his beneficiary will get no benefit.

If George is detected with an incurable ailment throughout the initial plan term, he probably will not be qualified to renew the policy when it expires. Some policies supply ensured re-insurability (without proof of insurability), yet such features come at a greater cost. There are several kinds of term life insurance policy.

Generally, most business offer terms ranging from 10 to 30 years, although a few deal 35- and 40-year terms. Level-premium insurance policy has a set month-to-month settlement for the life of the plan. Most term life insurance has a degree premium, and it's the kind we have actually been describing in a lot of this write-up.

Term Life Insurance For Couples

Term life insurance policy is attractive to youths with youngsters. Moms and dads can get significant protection for an inexpensive, and if the insured dies while the policy is in effect, the family members can rely upon the death advantage to change lost revenue. These policies are additionally well-suited for people with expanding households.

Term life policies are suitable for people that desire significant protection at a reduced price. Individuals that possess whole life insurance pay a lot more in costs for much less insurance coverage yet have the safety and security of knowing they are shielded for life.

The conversion rider must permit you to convert to any kind of irreversible plan the insurer supplies without constraints. The primary functions of the motorcyclist are keeping the original wellness ranking of the term policy upon conversion (also if you later have wellness concerns or come to be uninsurable) and deciding when and how much of the coverage to transform.

Obviously, total premiums will enhance substantially given that whole life insurance policy is a lot more pricey than term life insurance coverage. The benefit is the assured approval without a clinical examination. Medical conditions that develop during the term life duration can not trigger costs to be increased. The company might need restricted or full underwriting if you desire to include added bikers to the brand-new policy, such as a long-term care cyclist.

Whole life insurance comes with considerably higher regular monthly premiums. It is meant to offer coverage for as lengthy as you live.

High-Quality Short Term Life Insurance

It depends upon their age. Insurance business set a maximum age limitation for term life insurance policy plans. This is generally 80 to 90 years old but may be higher or lower depending on the company. The costs likewise climbs with age, so an individual aged 60 or 70 will pay considerably even more than someone years younger.

Term life is somewhat comparable to cars and truck insurance. It's statistically unlikely that you'll need it, and the premiums are cash down the tubes if you do not. If the worst takes place, your family will receive the benefits.

The most prominent type is now 20-year term. The majority of companies will certainly not offer term insurance to an applicant for a term that ends previous his/her 80th birthday celebration. If a plan is "renewable," that suggests it continues in pressure for an extra term or terms, as much as a defined age, even if the health of the insured (or other variables) would certainly trigger him or her to be turned down if she or he looked for a brand-new life insurance policy policy.

Premiums for 5-year eco-friendly term can be level for 5 years, then to a new rate reflecting the new age of the guaranteed, and so on every five years. Some longer term plans will certainly guarantee that the costs will certainly not enhance during the term; others don't make that assurance, making it possible for the insurer to increase the rate during the policy's term.

This means that the policy's proprietor can alter it right into a permanent kind of life insurance policy without extra proof of insurability. In a lot of kinds of term insurance coverage, including home owners and auto insurance, if you have not had a claim under the plan by the time it ends, you get no refund of the costs.

Premium A Renewable Term Life Insurance Policy Can Be Renewed

Some term life insurance coverage consumers have actually been miserable at this outcome, so some insurance companies have created term life with a "return of premium" feature. decreasing term life insurance. The premiums for the insurance coverage with this function are frequently considerably greater than for plans without it, and they generally need that you maintain the plan in force to its term or else you surrender the return of costs benefit

Degree term life insurance policy costs and survivor benefit remain constant throughout the policy term. Level term plans can last for periods such as 10, 15, 20 or three decades. Level term life insurance policy is commonly extra economical as it does not build cash money value. Degree term life insurance coverage is among one of the most common kinds of protection.

Reliable Annual Renewable Term Life Insurance

While the names often are used interchangeably, degree term protection has some important distinctions: the costs and survivor benefit stay the very same throughout of insurance coverage. Level term is a life insurance coverage plan where the life insurance policy costs and fatality advantage stay the same throughout of coverage.

Latest Posts

How To Sell Final Expense Insurance

Death Burial Insurance

Funeral Cover Up To 85 Years