All Categories

Featured

Table of Contents

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - term life insurance for mortgage protection agents recommend. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

It permits you to spending plan and prepare for the future. You can quickly factor your life insurance policy right into your budget due to the fact that the premiums never change. You can intend for the future equally as conveniently because you recognize precisely just how much money your loved ones will certainly obtain in the event of your absence.

This holds true for individuals who stopped cigarette smoking or that have a wellness condition that deals with. In these situations, you'll typically have to go via a new application process to obtain a much better price. If you still need protection by the time your level term life plan nears the expiration day, you have a few alternatives.

The majority of degree term life insurance policies include the option to restore protection on an annual basis after the first term ends. a term life insurance policy matures. The price of your plan will be based upon your current age and it'll enhance each year. This could be a good alternative if you only need to expand your insurance coverage for a couple of years or else, it can get pricey rather rapidly

Level term life insurance policy is one of the most inexpensive coverage options on the marketplace due to the fact that it offers basic security in the type of survivor benefit and just lasts for a set time period. At the end of the term, it expires. Entire life insurance policy, on the various other hand, is considerably much more pricey than degree term life because it doesn't run out and comes with a money value attribute.

Exceptional Term Life Insurance For Couples

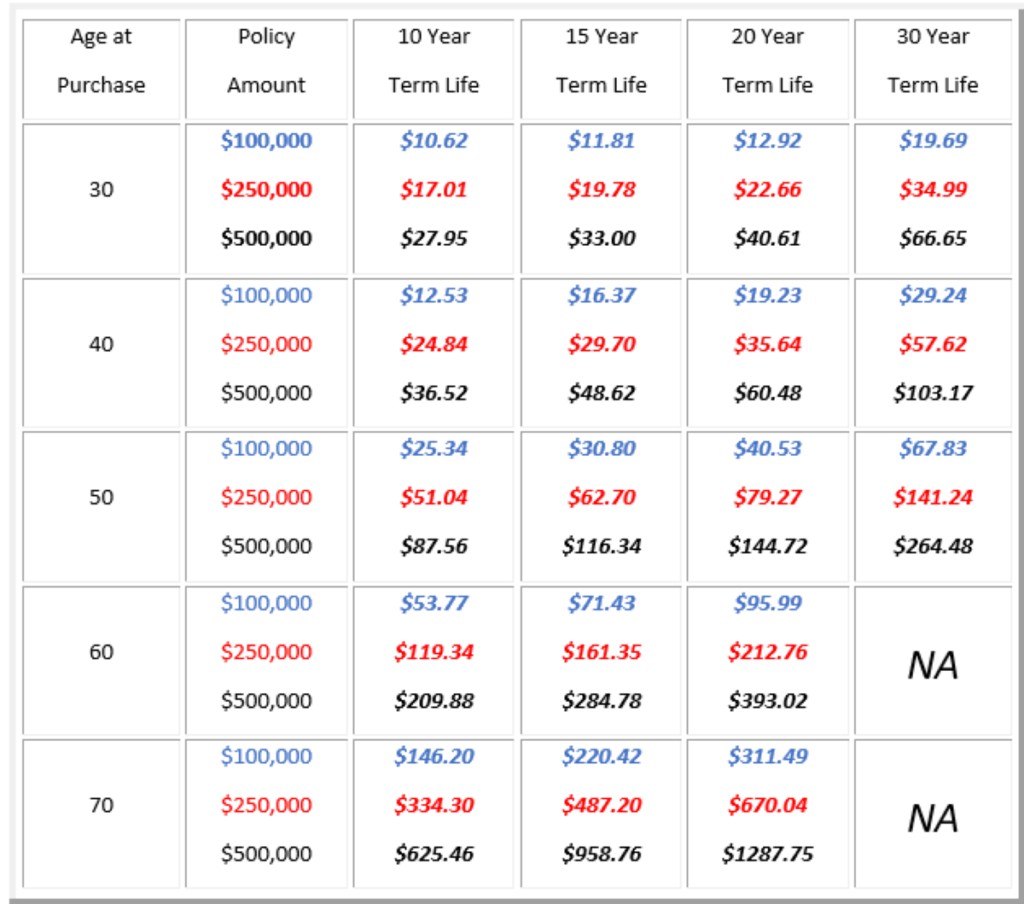

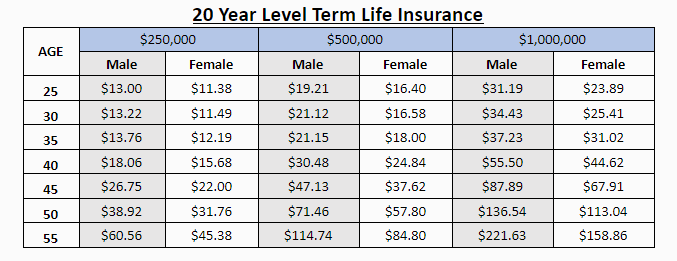

Prices might vary by insurance company, term, protection amount, health course, and state. Not all policies are readily available in all states. Rate image legitimate as of 10/01/2024. Level term is a great life insurance policy alternative for lots of people, but relying on your protection demands and personal situation, it might not be the very best fit for you.

Annual sustainable term life insurance coverage has a regard to only one year and can be restored yearly. Annual renewable term life premiums are at first less than level term life costs, however costs go up each time you restore. This can be an excellent option if you, as an example, have simply stop cigarette smoking and need to wait two or three years to apply for a level term policy and be eligible for a lower price.

What Is Decreasing Term Life Insurance

With a decreasing term life policy, your survivor benefit payment will certainly decrease with time, however your settlements will certainly remain the exact same. Decreasing term life policies like mortgage security insurance coverage typically pay to your lender, so if you're trying to find a plan that will certainly pay to your loved ones, this is not a good fit for you.

Increasing term life insurance policy policies can aid you hedge versus inflation or strategy economically for future youngsters. On the other hand, you'll pay even more ahead of time for less coverage with a boosting term life plan than with a degree term life plan. If you're not sure which type of plan is best for you, collaborating with an independent broker can help.

As soon as you have actually chosen that degree term is ideal for you, the next step is to buy your plan. Right here's exactly how to do it. Determine how much life insurance policy you require Your coverage quantity should offer your family's long-lasting monetary requirements, consisting of the loss of your earnings in the event of your fatality, in addition to financial obligations and everyday expenses.

A level premium term life insurance policy plan allows you stick to your budget plan while you help secure your family members. ___ Aon Insurance Coverage Services is the brand name for the brokerage firm and program management procedures of Fondness Insurance Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Agency, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Coverage Services Inc.; in CA, Aon Fondness Insurance Solutions, Inc.

The Strategy Representative of the AICPA Insurance Coverage Trust, Aon Insurance Policy Services, is not associated with Prudential.

Latest Posts

How To Sell Final Expense Insurance

Death Burial Insurance

Funeral Cover Up To 85 Years