All Categories

Featured

Table of Contents

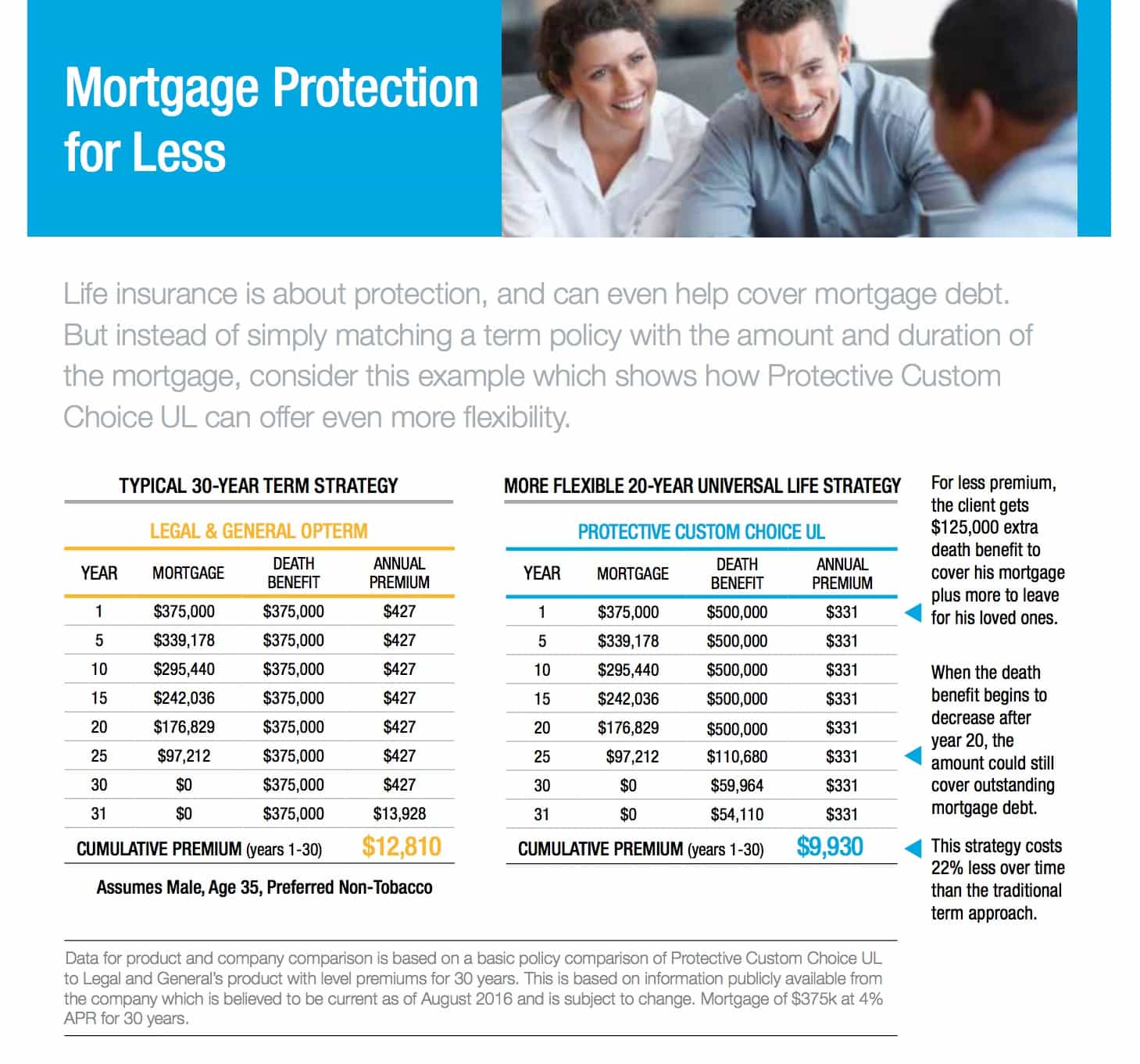

Life insurance representatives market mortgage defense and loan providers sell mortgage protection insurance, sometime. joint mortgage payment protection insurance. Below are the two kinds of representatives that offer home loan protection (largest mortgage insurance companies).

Getting home loan protection with your loan provider is not constantly a very easy job, and typically times quite complex. Lenders usually do not offer home mortgage defense that profits you.

Mortgage Insurance Policy

The letters you get show up to be coming from your loan provider, however they are simply coming from third event firms. what is mortgage insurance cover. If you do not end up getting standard home loan defense insurance policy, there are other kinds of insurance coverage you might been needed to have or might wish to take into consideration to secure your financial investment: If you have a home mortgage, it will be needed

Specifically, you will desire home coverage, materials coverage and personal liability. mortgage insurance requirement. Additionally, you should think about adding optional insurance coverage such as flood insurance policy, earthquake insurance coverage, substitute price plus, water backup of sewage system, and other frameworks insurance policy for this such as a gazebo, shed or unattached garage. Simply as it appears, fire insurance is a kind of residential or commercial property insurance policy that covers damages and losses caused by fire

This is the main choice to MPI insurance coverage. Whole life is a permanent plan that is much more costly than term insurance coverage but lasts throughout your entire life.

Insurance coverage is usually restricted to $25,000 or much less, however it does shield versus needing to tap various other funds when a person passes away (why do you need mortgage insurance). Last expense life insurance policy can be made use of to cover clinical costs and various other end-of-life costs, consisting of funeral service and interment prices. It is a kind of long-term life insurance that does not end, yet it is an extra costly that term life insurance coverage

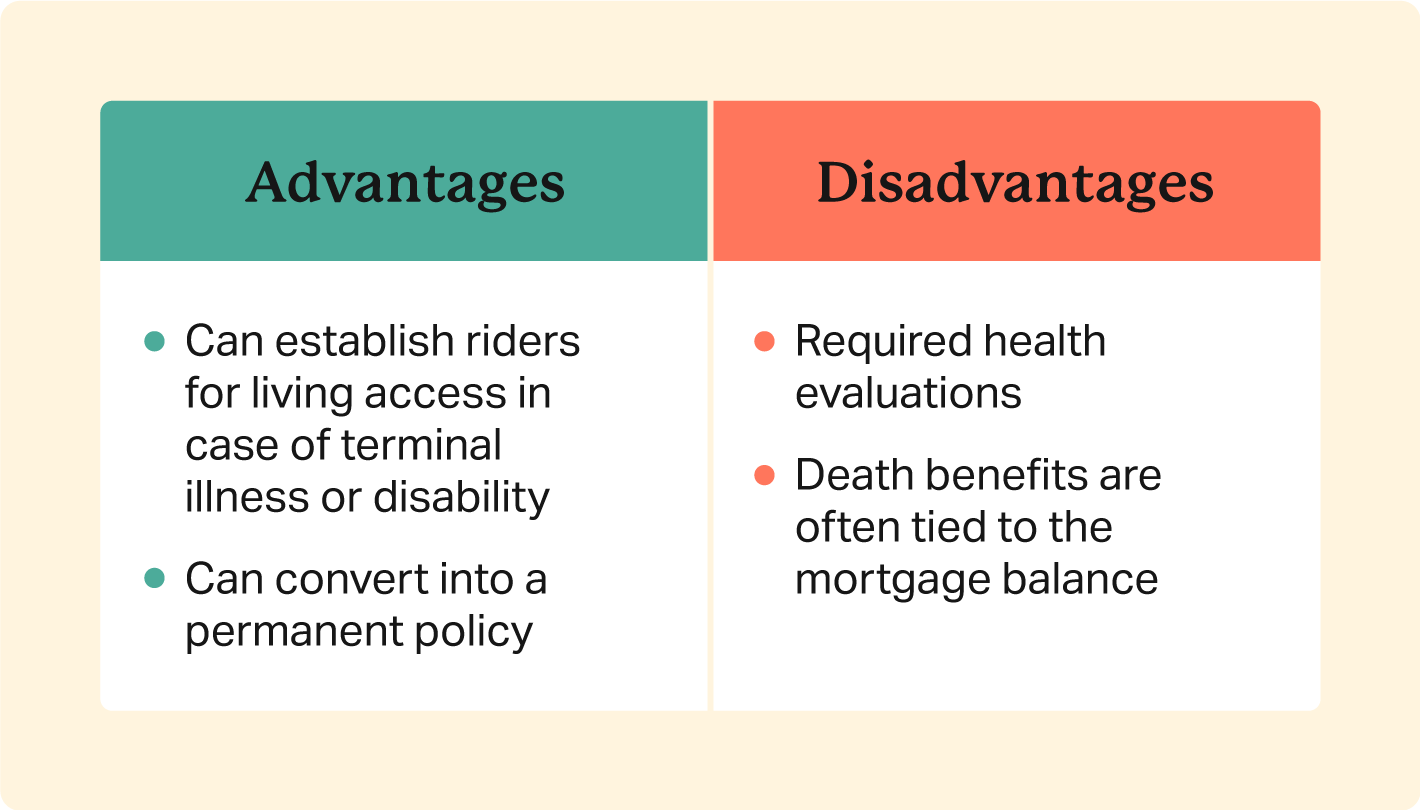

Pros And Cons Of Mortgage Insurance

Some funeral chapels will accept the assignment of a final cost life insurance policy and some will certainly not. Some funeral chapels need settlement up front and will certainly not wait till the final cost life insurance coverage plan pays out. It is best to take this into factor to consider when dealing when considering a final cost in.

Benefit settlements are not assessable for revenue tax functions. You have a number of choices when it concerns purchasing home mortgage protection insurance coverage (mortgage insurance payoff). Many companies are extremely ranked by A.M. Finest, and will certainly offer you the included self-confidence that you are making the best choice when you acquire a plan. Among these, from our viewpoint and experience, we have found the complying with companies to be "the very best of the very best" when it concerns issuing home loan protection insurance coverage, and suggest any kind of one of them if they are choices offered to you by your insurance representative or mortgage lender.

Mortgage Repayment Protection Insurance

Can you obtain mortgage security insurance policy for homes over $500,000? The largest difference in between home loan defense insurance policy for homes over $500,000 and homes under $500,000 is the requirement of a medical examination.

Every company is different, however that is a good general rule. Keeping that claimed, there are a couple of business that use home loan protection insurance coverage as much as $1 million with no medical exams. mortgage insurance plan. If you're home deserves less than $500,000, it's highly most likely you'll get strategy that does not need medical examinations

Home loan security for low earnings housing typically isn't needed as the majority of reduced income real estate systems are rented out and not had by the passenger. Nonetheless, the proprietor of the systems can definitely buy home loan defense for reduced income housing system occupants if the policy is structured properly. In order to do so, the property owner would require to deal with an independent representative than can structure a group plan which enables them to consolidate the owners on one plan.

If you have questions, we highly suggest talking with Drew Gurley from Redbird Advisors. Drew Gurley is a member of the Forbes Financing Council and has actually worked a few of the most special and varied home mortgage defense strategies - mortgage insurance health questions. He can definitely assist you analyze what is required to place this sort of plan together

Takes the guesswork out of safeguarding your home if you die or end up being handicapped. Money goes straight to the mortgage company when a benefit is paid out.

Latest Posts

How To Sell Final Expense Insurance

Death Burial Insurance

Funeral Cover Up To 85 Years