All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. business life insurance policies from brokers. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

That commonly makes them an extra affordable choice permanently insurance policy coverage. Some term plans may not keep the costs and survivor benefit the very same with time. You do not want to mistakenly think you're buying degree term insurance coverage and then have your survivor benefit change later. Many individuals obtain life insurance policy coverage to aid monetarily safeguard their loved ones in situation of their unexpected fatality.

Or you may have the alternative to transform your existing term insurance coverage right into an irreversible plan that lasts the remainder of your life. Numerous life insurance policy policies have prospective advantages and disadvantages, so it's important to understand each before you determine to buy a policy.

As long as you pay the premium, your recipients will get the death advantage if you die while covered. That claimed, it is essential to keep in mind that a lot of policies are contestable for two years which means protection could be rescinded on fatality, ought to a misstatement be found in the application. Policies that are not contestable frequently have actually a graded death advantage.

Costs are usually reduced than whole life plans. You're not secured right into a contract for the rest of your life.

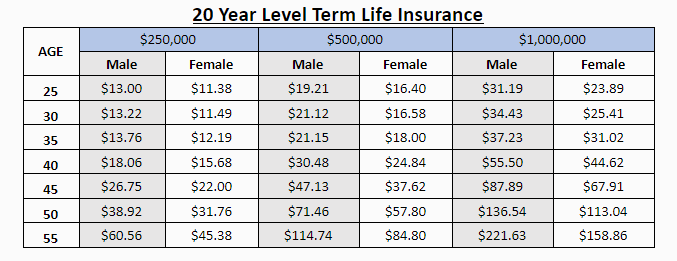

And you can not squander your plan throughout its term, so you won't get any monetary gain from your previous coverage. As with other types of life insurance policy, the cost of a level term plan depends upon your age, protection demands, employment, way of life and wellness. Normally, you'll find extra budget friendly protection if you're more youthful, healthier and less high-risk to guarantee.

Innovative A Term Life Insurance Policy Matures

Considering that level term costs stay the exact same throughout of insurance coverage, you'll recognize specifically just how much you'll pay each time. That can be a huge assistance when budgeting your expenses. Degree term protection likewise has some adaptability, enabling you to personalize your policy with extra functions. These frequently come in the type of cyclists.

You may need to fulfill certain problems and qualifications for your insurance firm to pass this motorcyclist. On top of that, there may be a waiting period of approximately six months before working. There likewise could be an age or time frame on the protection. You can include a youngster rider to your life insurance coverage policy so it additionally covers your children.

The survivor benefit is typically smaller sized, and coverage generally lasts up until your youngster transforms 18 or 25. This motorcyclist may be a much more cost-efficient way to assist guarantee your kids are covered as riders can typically cover multiple dependents at as soon as. Once your child ages out of this protection, it might be feasible to transform the rider right into a brand-new plan.

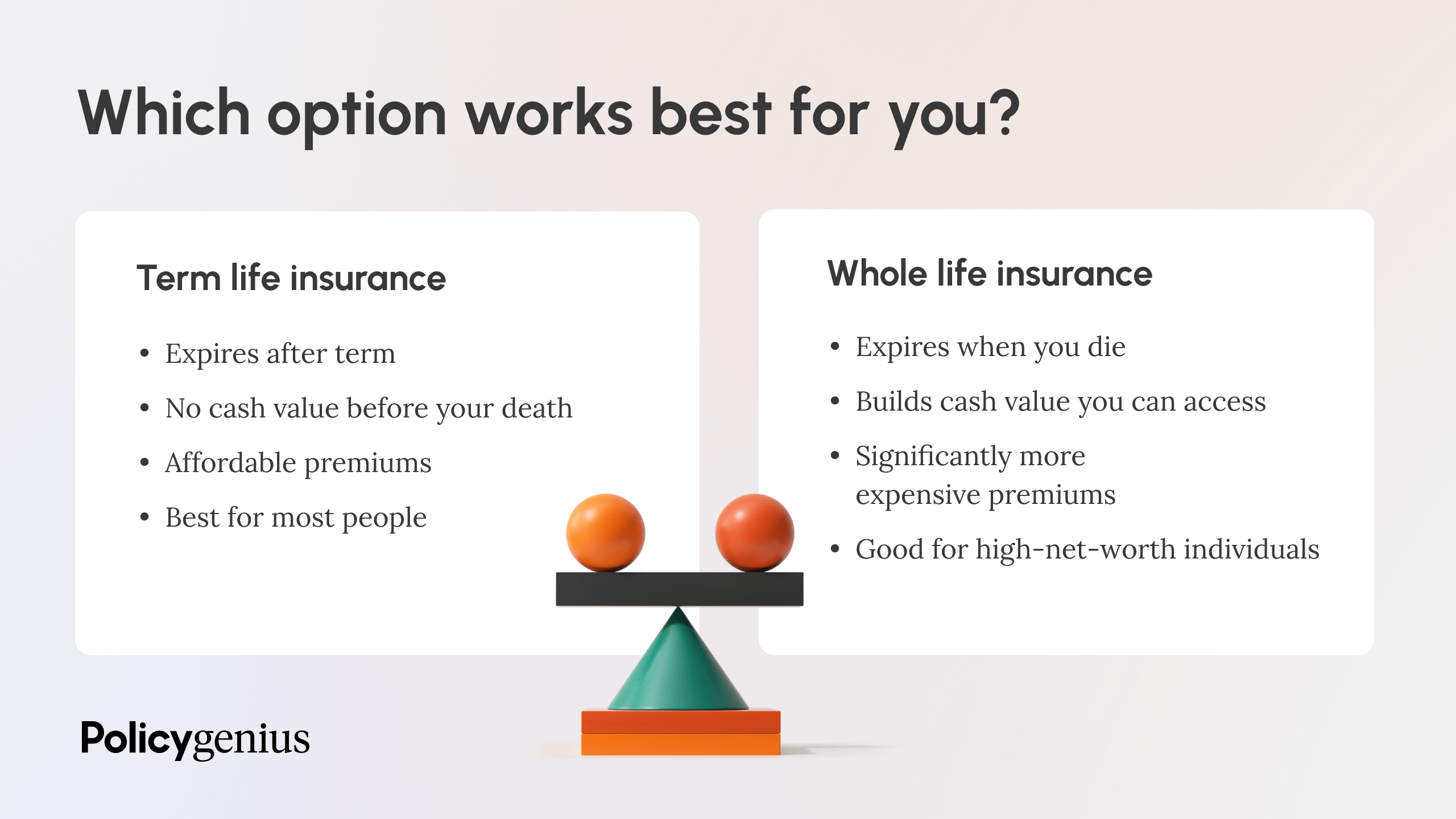

The most usual kind of long-term life insurance is whole life insurance coverage, but it has some key distinctions contrasted to degree term coverage. Right here's a basic summary of what to take into consideration when contrasting term vs.

Honest Term Life Insurance For Couples

Whole life insurance lasts for life, while term coverage lasts for a specific periodCertain The premiums for term life insurance policy are normally lower than entire life protection.

One of the major features of degree term insurance coverage is that your costs and your fatality advantage do not alter. You may have protection that begins with a death advantage of $10,000, which can cover a home mortgage, and then each year, the fatality advantage will decrease by a collection quantity or portion.

As a result of this, it's usually an extra affordable sort of level term protection. You might have life insurance policy with your employer, but it may not suffice life insurance policy for your demands. The first action when purchasing a plan is establishing how much life insurance policy you need. Think about aspects such as: Age Family members dimension and ages Work standing Earnings Financial debt Way of living Expected last costs A life insurance coverage calculator can assist identify just how much you require to begin.

After selecting a plan, finish the application. For the underwriting procedure, you may have to provide basic individual, health and wellness, lifestyle and employment information. Your insurer will establish if you are insurable and the threat you might provide to them, which is reflected in your premium prices. If you're approved, sign the documents and pay your very first premium.

Specialist Group Term Life Insurance Tax

Think about scheduling time each year to assess your plan. You might wish to upgrade your beneficiary details if you've had any kind of substantial life adjustments, such as a marriage, birth or separation. Life insurance policy can often feel complex. Yet you don't have to go it alone. As you explore your alternatives, take into consideration reviewing your demands, desires and worries with a monetary professional.

No, level term life insurance coverage doesn't have cash worth. Some life insurance policy policies have a financial investment feature that enables you to develop cash money worth gradually. A section of your costs payments is alloted and can earn interest over time, which grows tax-deferred throughout the life of your insurance coverage.

You have some alternatives if you still desire some life insurance policy coverage. You can: If you're 65 and your insurance coverage has run out, for instance, you might want to acquire a brand-new 10-year level term life insurance coverage plan.

Honest Annual Renewable Term Life Insurance

You might be able to convert your term insurance coverage right into an entire life policy that will certainly last for the remainder of your life. Many kinds of level term plans are exchangeable. That implies, at the end of your coverage, you can convert some or all of your plan to whole life coverage.

Level term life insurance coverage is a plan that lasts a set term typically in between 10 and thirty years and comes with a level survivor benefit and level costs that remain the very same for the entire time the policy holds. This means you'll recognize precisely just how much your payments are and when you'll have to make them, allowing you to spending plan as necessary.

Level term can be a fantastic alternative if you're seeking to buy life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance coverage Measure Research Study, 30% of all grownups in the united state demand life insurance policy and don't have any kind of kind of policy yet. Degree term life is predictable and inexpensive, that makes it one of one of the most prominent sorts of life insurance policy.

Latest Posts

How To Sell Final Expense Insurance

Death Burial Insurance

Funeral Cover Up To 85 Years